BasisDrive – your classic annual car insurance policy

Simple, safe and flexible — without tracking or kilometre-based billing.

Do you want straightforward car insurance without extras such as kilometre-based billing or tracking?

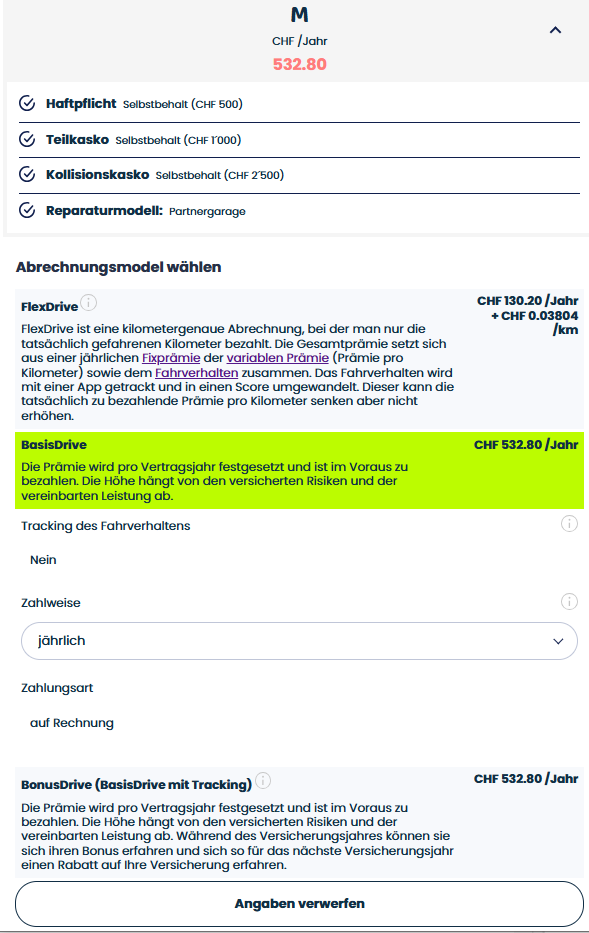

With BasisDrive from simpego, you get a classic annual insurance policy that offers you stability and planning security. The premium is fixed and transparent, and you decide whether you want to pay it annually or half-yearly in advance – for full protection and flexibility, just as you need it.

BasisDrive payment method

With BasisDrive, you pay your premium in advance by invoice, which we send to you by email. When you take out the policy, you can choose between:

- half-yearly

- yearly

Frequently asked questions about BasisDrive

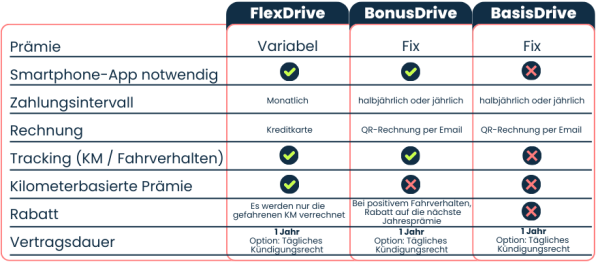

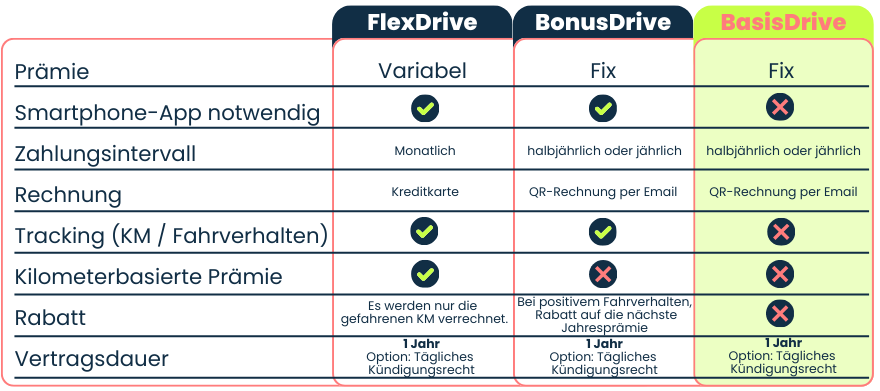

What is the difference between BasisDrive and other billing models such as FlexDrive?

BasisDrive is a classic ‘flat-rate car insurance’ with a fixed annual premium.

Unlike FlexDrive, there is no kilometre-based billing. And unlike BonusDrive, your driving behaviour is not monitored.

BasisDrive is suitable for anyone who wants a stable and transparent insurance without an additional smartphone app.

How do I pay at BasisDrive?

You will receive your invoice from us by email.

The first payment is due upon conclusion of the contract, or no later than 40 days before the start of the contract.

How often does the BasisDrive premium need to be paid?

When you take out the policy, you choose whether you want to pay your premium annually or semi-annually.

Is BasisDrive suitable for all types of vehicles?

Yes – BasisDrive is suitable for all common vehicles. No matter how frequently you use your car, motorbike, camper, classic car or van, you enjoy full insurance cover without any additional conditions.

Do I have to document my mileage (km) or my driving behaviour?

No. With BasisDrive, you no longer have to keep track of your driving behaviour or count kilometres. Your fixed premium remains the same for the whole year.

I drive more than 20,000 kilometres a year. Do I have to report this?

No — with BasisDrive, the kilometres are not relevant. This insurance works like a ‘flat rate’: your premium remains the same throughout the year, regardless of how many kilometres you drive!

I have two vehicles with transferable plates. Can I use BasisDrive with them?

Yes. With BasisDrive, it is possible to take out an insurance policy for two vehicles on a pair of interchangeable licence plates.

Is BasisDrive available to corporate customers?

Yes, BasisDrive is also available for business customers and company fleets.

I have a motorcycle insured with simpego. Can I choose BasisDrive for it?

Yes. BasisDrive is available for all types of vehicles, whether they be cars, motorbikes, vintage cars, camper vans or delivery vans.

Who is BasisDrive for?

BasisDrive is the ideal choice for drivers who want a simple, proven car insurance policy – with no technical gimmicks and no mileage charges. It is aimed at people who value stability and transparency and want to know exactly what they are paying.

Car owners: who appreciate a fixed cost insurance solution with no variable costs and no surprises — simple, transparent and reliable.

Professionals and frequent drivers: who use their car every day and drive more than 12,000 km per year.

Drivers: who value traditional insurance without smartphone apps or gadgets.

Carpoolers: couples, families or communities with several registered drivers — ideal for those who don’t want to worry about measuring their driving style.

Company fleets: reliable protection for companies looking for clear and easy-to-manage cover for their vehicles.

Motorcycle, vintage car and van drivers: for those insuring a special vehicle and wanting solid protection.

BasisDrive offers you the protection you need – simple, clear, and reliable.

Other billing options available with simpego

FlexDrive

FlexDrive is a billing model where you only pay for the kilometres you actually drive, i.e. ‘pay as you drive’.

The total premium is made up of a fixed premium, a variable premium and your driving behaviour (see BonusDrive).

Any discount you receive for good driving behaviour is applied to the variable part of the total premium.

BonusDrive

BonusDrive is an insurance model where the premium is fixed per year and paid in advance. The premium is based on the insured risks and the agreed benefits. Good driving behaviour during the insurance year can result in a bonus of up to 20% on the premium for the following insurance year.

Explore all payment options

FlexDrive, BonusDrive and BasisDrive: a comparison of all billing models.

Find out more about FlexDrive and BonusDrive