FlexDrive – Your car insurance per kilometre

Do you drive less? simpego FlexDrive is the tailor-made solution for your low annual mileage, allowing you to pay only for the kilometers you actually drive.

Flexibility is more important today than ever – so why not apply that to car insurance? Imagine paying only for the kilometres you actually drive. That’s exactly what FlexDrive, the flexible car insurance from simpego, offers you.

Whether you use your car every day or only occasionally, FlexDrive gives you full control over your costs. Find out how you can save money while enjoying the best coverage for your vehicle.

Why FlexDrive?

The advantages of flexible car insurance

Conventional car insurance policies usually charge a fixed annual premium, even if you only drive your car occasionally. With FlexDrive, you only pay for the kilometres you actually drive, and you can get a discount for good driving behaviour. That means:

- Full cost control: No unnecessary costs for infrequent drivers.

- Easy billing: Mileage-based insurance – perfect for occasional drivers and commuters.

- Environmentally friendly driving: Drive less, pay less – and make a positive contribution to climate protection at the same time.

This kilometer-based insurance allows you to flexibly adjust your monthly costs based on your driving style.

How does FlexDrive work?

Simple kilometre billing – without a dongle or GPS tracker!

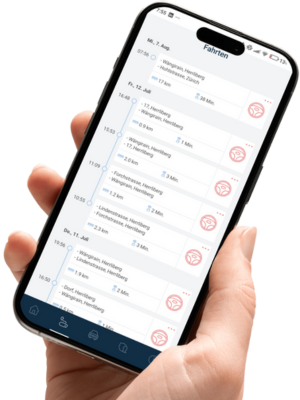

FlexDrive is straightforward and makes mileage billing easy, without the need for fixed devices such as dongles, GPS trackers or black boxes. Instead, everything is conveniently managed via the FlexDrive app on your smartphone.

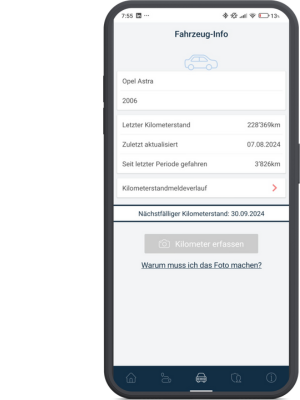

Once a month, you simply submit your current mileage: simply take a photo of your mileage, enter it in the app and upload the photo. Your smartphone also records driving style and location data and uses this to calculate your personal score. A good score has a positive effect on your flexible premium share.

With FlexDrive, you benefit from maximum transparency and flexibility: you only pay for the kilometres you have actually driven – without any additional devices or complicated installations.

Billing is done in two simple steps:

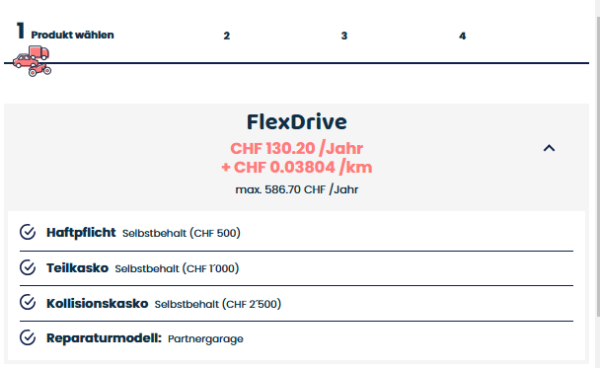

- Base premium: a fixed amount that includes basic cover such as liability insurance and is paid regardless of the number of kilometres driven.

- Mileage-based premium: You only pay for the miles you drive. Exact billing is based on the mileage reports you submit each month.

This combination of flexibility and cost efficiency makes FlexDrive the perfect solution for anyone who wants to tailor their car insurance to their actual driving needs – without high fixed costs and complicated technology.

Frequently asked questions about FlexDrive

How is the FlexDrive premium calculated?

You pay a basic premium and a kilometre-based premium based on the kilometre reading you have reported. Simply enter the kilometre reading in the customer portal or in the app once a month.

How does billing work for FlexDrive without telematics?

FlexDrive makes billing simple and transparent. You enter the kilometres you have driven in the app once a month. The corresponding costs are automatically debited to your credit card. This means you only ever pay for the kilometres you have actually driven in the previous month.

What happens if I don’t use the car at all?

Even if you don’t drive, you still have to take a current photo of your odometer once a month and enter the mileage in the app.

We will then only charge you the fixed premium in the next invoice, which is due regardless of the kilometres driven.

Do I have to upgrade my car’s technology or have telematics installed?

No! With FlexDrive, you can do without telematics or built-in components. You simply send a photo of your odometer and manually enter the current mileage.

How often do I have to report the mileage?

You report your mileage once a month. To do this, take a photo of the odometer and enter the current reading in the customer portal or in the app.

How exactly is the mileage checked?

Simpego trusts you and the information you provide. With FlexDrive, you simply record the kilometres you have driven yourself. Using the FlexDrive app, you manually enter your mileage once a month and upload a photo of your mileagein the app.

How is the FlexDrive premium calculated and how does my driving behaviour affect it?

With FlexDrive, you only pay for the kilometres you actually drive.

The total premium is made up of two parts:

A fixed premium and a variable premium. The fixed premium covers your basic insurance, while the variable premium is based on the kilometres you drive. In addition, your driving behaviour can affect the variable premium – if you drive carefully and economically, you can receive a discount on this variable part of your premium.

What happens if I forget to report the mileage?

If you don’t report the mileage in time, an estimate will be made based on your previous driving behaviour. However, you can add the mileage at any time.

Do I need to install a dongle, GPS tracker or black box for FlexDrive?

No. FlexDrive does not require a dongle, GPS tracker or black box.

FlexDrive does not use telematics devices or adapters to collect telematics data. Instead, you simply install the FlexDrive app on your smartphone and report the kilometres you have driven manually via the app, uploading a photo of your odometer.

Can I also use FlexDrive for my company?

No, FlexDrive can currently only be used by private individuals and is not available to companies.

I own a classic car – can I add FlexDrive to my contract for it?

Unfortunately, this is not possible at the moment. BonusDrive is currently only available for private individuals with a passenger car that is insured through our online application process.

I have a motorbike. Can I also take out FlexDrive for my motorcycle insurance?

No, FlexDrive is currently only available for personal auto insurance.

I have two vehicles with a removable number plate. Can I switch to FlexDrive?

No, with FlexDrive you can only insure one vehicle per contract. Unfortunately, it is therefore not possible to switch using a transfer plate.

This is how you register: Activate FlexDrive in just a few steps

Registering with FlexDrive, Switzerland’s kilometre-based car insurance, is easy and requires no technical installation. You can be insured in just a few steps:

- Take out your car insurance online: and select FlexDrive as an option.

- Install the app: directly from Google Play or the App Store.

- Register your mileage: After registering, you enter your current mileage via the app. To do this, simply take a photo of your odometer and enter the mileage manually.

- Drive and report monthly: You report your mileage once a month – it’s easy – and you only pay for the kilometres you’ve driven.

- Simple billing: your kilometres driven are conveniently charged to your credit card.

Who is FlexDrive suitable for?

FlexDrive, the insurance based on kilometres driven, is the perfect solution for:

- Occasional drivers: Do you only drive your car at the weekend or for special occasions? If you only drive a few kilometres a month, you can significantly reduce your fixed costs with FlexDrive. FlexDrive saves you money.

- Commuters using alternative means of transport: Do you often use the train or your bike? Then you only pay for the kilometres you actually cover by car.

- Environmentally conscious drivers: driving less not only means lower costs, but also a smaller carbon footprint. FlexDrive supports sustainable mobility.

Please note: FlexDrive is currently only available for personal car insurance. The pay-as-you-drive solution is not yet available for corporate clients, classic cars or motorcycles.

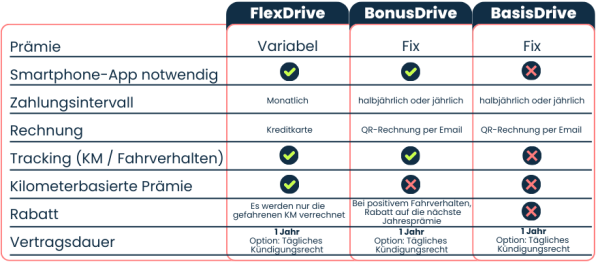

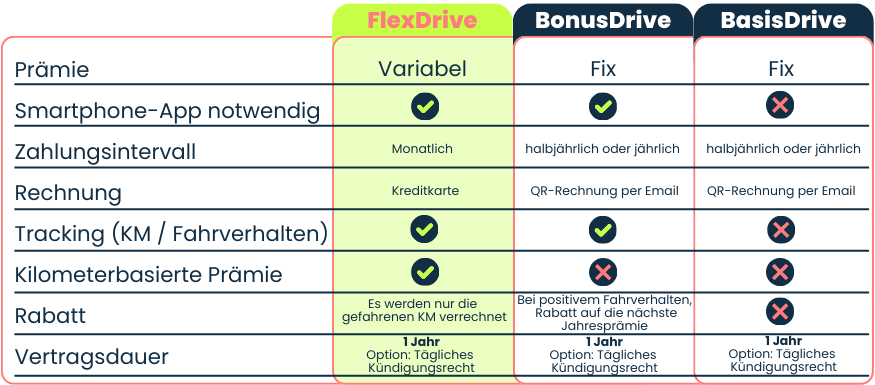

FlexDrive, BasisDrive and BonusDrive: what are they?

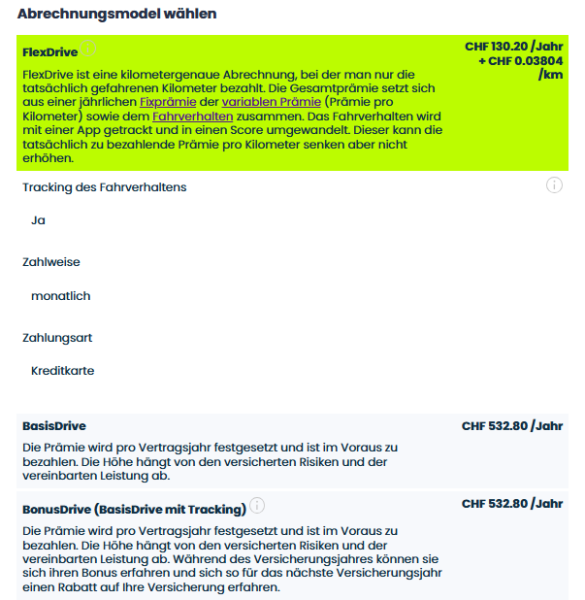

FlexDrive

FlexDrive is a billing model in which you only pay for the kilometres you actually drive, i.e. ‘pay as you drive’.

The total premium is made up of a fixed premium, a variable premium and your driving behaviour (see BonusDrive).

Any discount you receive for good driving behaviour is applied to the variable portion of the total premium.

BonusDrive

BonusDrive is an insurance model where the premium is set per policy year and paid in advance. The amount of the premium depends on the insured risks and the agreed services. During the insurance year, you have the opportunity to receive a bonus for good driving behaviour, which will give you a discount on your insurance in the next insurance year.

BasisDrive

BasisDrive is the classic insurance model, where the premium is set for each policy year and paid for in advance.

The amount of the premium is based on the insured risks and the agreed service.

How does the driving behaviour tracking work for FlexDrive and BonusDrive?

Driver behaviour tracking is an important part of FlexDrive and BonusDrive.

To do that, you need the simpego FlexDrive app. As soon as your contract has been issued, you will receive an SMS and an e-mail with instructions for downloading the app and registering. As soon as you give the app permission to monitor your trips, it will run in the background. You don’t have to manually start the app each time or do anything special before each trip. You will receive all further information in the app by e-mail after registering.

FlexDrive compared to the other billing models

Customer experiences with FlexDrive: What users say

Download the app and start saving!

FlexDrive, BonusDrive & Basis Drive in comparison

Discover our three payment options:

- FlexDrive: Pay only for the kilometres you actually drive.

- BonusDrive: Drive safely and earn up to 20% off your premium.

- BasisDrive: The flat-rate insurance – with no mileage limit, just carefree driving.