BonusDrive — The smart way to insure your car for less

Drive smart, save more! With BonusDrive, you can positively influence your driving behaviour and get a discount of up to 20% on your next premium by driving safely.

What is BonusDrive?

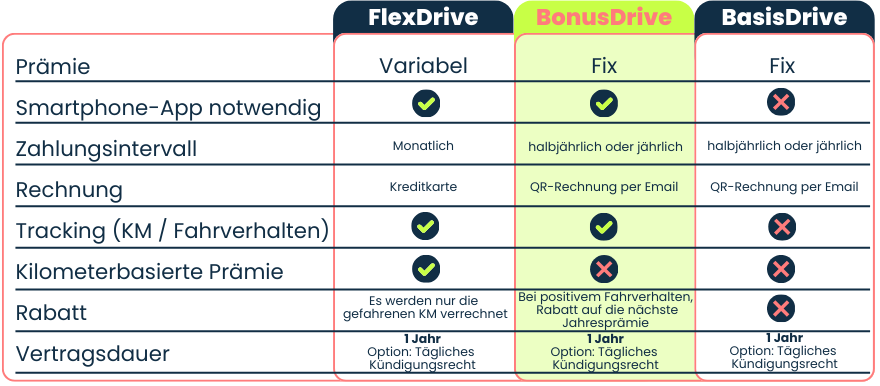

BonusDrive is our reward system for forward-thinking drivers. With our app, you can improve your driving style. In contrast to the mileage-based billing model FlexDrive, with BonusDrive you pay an annual premium, which is influenced by your driving behaviour. Achieve a high score through regular and safe driving and get an attractive discount of up to 20% on your next annual premium!

Why BonusDrive?

Your advantage with BonusDrive: with BonusDrive you stay mobile and independent – no matter how many kilometres you drive per year. Your premium remains fixed and works like a flat rate. The best part is: with safe driving and a high score, you can even reduce your premium by up to 20% the following year!

How does the billing work?

With BonusDrive, there are no surprises: when you take out your policy, you decide whether you want to pay your premium annually or semi-annually. And the best part: depending on your score, you can secure a discount on the total annual premium for the next year!

How does BonusDrive work?

Easily track your driving style, without a dongle or GPS tracker!

- Take out simpego car insurance with BonusDrive as the payment option.

- Download our app and register: All you need is a mobile phone number to use the app.

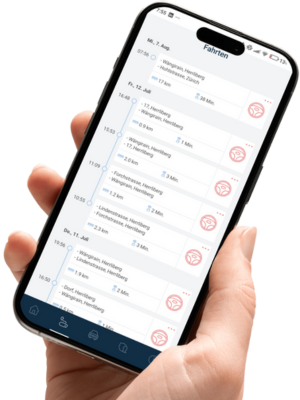

- Track your driving behaviour: Use our smartphone app and let us analyse your driving. The app measures your driving behaviour so that you can improve your score by driving safely.

- Kilometres at a glance: Like FlexDrive, BonusDrive queries your kilometres monthly so that all trips are reliably recorded.

- Improve your score and lower your premium: Once you have tracked 100 trips, you will be rewarded with a score that can give you a discount of up to 20% on your next insurance premium.

Frequently asked questions about BonusDrive

What is the advantage of BonusDrive over other forms of payment?

BonusDrive offers you the opportunity to collect discounts for safe driving without paying per kilometre. Your annual premium remains fixed, but your score can secure you a discount on the premium for the following year.

How often do I have to use the app to get discounts?

To benefit from BonusDrive, you should always have your smartphone with our app. When you have registered 100 trips, you can see your points balance in the app.

From what score do I get a discount?

You must achieve a score of at least 83.

The higher your score, the higher your future premium discount!

What happens if I score less than 83 points?

If you don’t get more than 83 points, unfortunately you won’t get a

Do I need to upgrade the technology in my car or have telematics installed?

No. To benefit from BonusDrive, you don’t need telematics or installations. We measure your driving behaviour with the smartphone app.

Is the use of the app mandatory?

Yes, to benefit from BonusDrive, you need to use the app to record trips and kilometres. You should also always have your smartphone with you.

Your score is based on this usage and then leads to discounts.

How much is the discount from BonusDrive?

You can get up to a 20% discount on your next billing cycle if you have a good score.

Can I use BonusDrive for my business?

No, BonusDrive is currently only available for private individuals and is not available for companies.

I have a vintage car – can I include BonusDrive in my contract for it?

Unfortunately not. At present, BonusDrive is only available for private individuals with a passenger car that can be insured through our online application process.

I have a motorbike. Can I take out BonusDrive for my motorbike insurance as well?

No, Bonus Drive is currently only available for personal car insurance.

I have two vehicles with a removable licence plate. Can I switch to BonusDrive for both vehicles?

No, BonusDrive can only be taken out for one vehicle per contract.

This is how you register: Activate BonusDrive in a few steps

Registering for BonusDrive is easy and requires no technical installations. You can be insured in just a few steps:

- Take out your car insurance online: and select BonusDrive as your payment option.

- Install the app: directly from Google Play or the App Store.

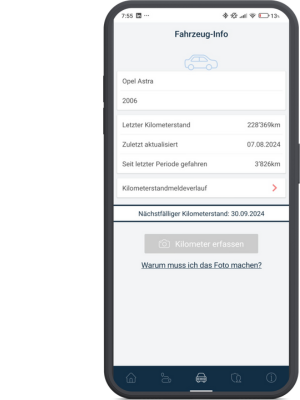

- Report your mileage: After registering, you submit your current mileage via the app. Simply take a photo of your odometer and enter the mileage manually.

- Drive and report monthly: You report your mileage once a month – easily and conveniently via the app.

- Easy billing: We will send you an invoice by email at the desired intervals (annually or semi-annually).

- Benefit from a discount: From the second contract year onwards, your score from the previous year counts.

For whom is the BonusDrive suitable?

BonusDrive is the ideal choice for anyone looking for car insurance tailored to their individual needs – without paying attention to the annual kilometres driven, but still wanting to save money.

- Safety-conscious drivers: Those who value a careful driving style will be rewarded with a good score and can secure attractive discounts for the next insurance period.

- Occasional drivers: For those who only drive occasionally but still want comprehensive insurance coverage, BonusDrive is the right choice. You only pay an annual premium and do not have to account for each kilometre.

- New drivers: BonusDrive offers an excellent opportunity to actively improve driving behaviour while benefiting from a bonus programme – ideal for new drivers who want to drive safely.

- Commuters and professionals: Those who often drive to work and want to regularly monitor their mileage have a clever way to analyse their driving style and optimise their contribution with BonusDrive.

- Environmentally conscious drivers: BonusDrive motivates those who already drive in an environmentally friendly and forward-thinking manner to further improve their driving behaviour while reducing their insurance costs.

- Second cars: BonusDrive is also ideal for anyone who uses a second car and wants to save costs. With a safe driving style, the second car can also benefit from discounts.

In brief: BonusDrive is ideal for all those who drive responsibly, keep an eye on their costs and don’t want to miss out on attractive discounts.

Please note: BonusDrive is currently only available for personal car insurance. For other vehicles (such as vintage cars, motorcycles, or caravans) as well as for companies and vehicles with interchangeable licence plates, BasisDrive is available as a billing model.

FlexDrive, BasisDrive: what is that?

FlexDrive

FlexDrive is a billing modell in which you only pay for the kilometres you actually drive, i.e. ‘pay as you drive’.

The total premium is made up of a fixed premium, a variable premium and your driving behaviour.

Any discount you receive for good driving behaviour is applied to the variable part of the total premium.

BasisDrive

BasisDrive is the classic insurance model, where the premium is set for each policy year and paid for in advance.

The amount of the premium is based on the insured risks and the agreed service.

How does the driving behaviour tracking work for FlexDrive and BonusDrive?

Driving behaviour tracking is an important part of FlexDrive and BonusDrive.

To do this, you need the simpego FlexDrive app. As soon as your contract has been issued, you will receive an SMS and an e-mail with instructions for downloading the app and registering. As soon as you give the app permission to monitor your trips, it will run in